BUYING AN APARTMENT AS AN LLC (LIMITED LIABILITY CORPORATION)

Since becoming legal in New York State in 1994, LLCs — hybrid entities that provide a shield against liability and offer several tax advantages — have become one of the most dominant ways to buy property in the city, According to the Real Deal . Most condo buildings make the process relatively simple. Unlike a co-op, a condo can't say yes or no to your purchase, all they can do is exercise the board's right of first refusal, which very few buildings do. [3] A condo's right of first refusal essentially tells the purchaser that the condo has no need to directly purchase the unit being transferred, and therefore you as a buyer can proceed with your transaction and become an owner in the building.

According to Ross Levine, “There are tax implications associated with any choice and typically if the parents are buying for their adult children, we usually recommend creating an LLC in NYS which is owned by a newly formed Trust. This would protect the asset in the time of an Estate proceeding and will avoid any issues with a buyer being a foreign person.”

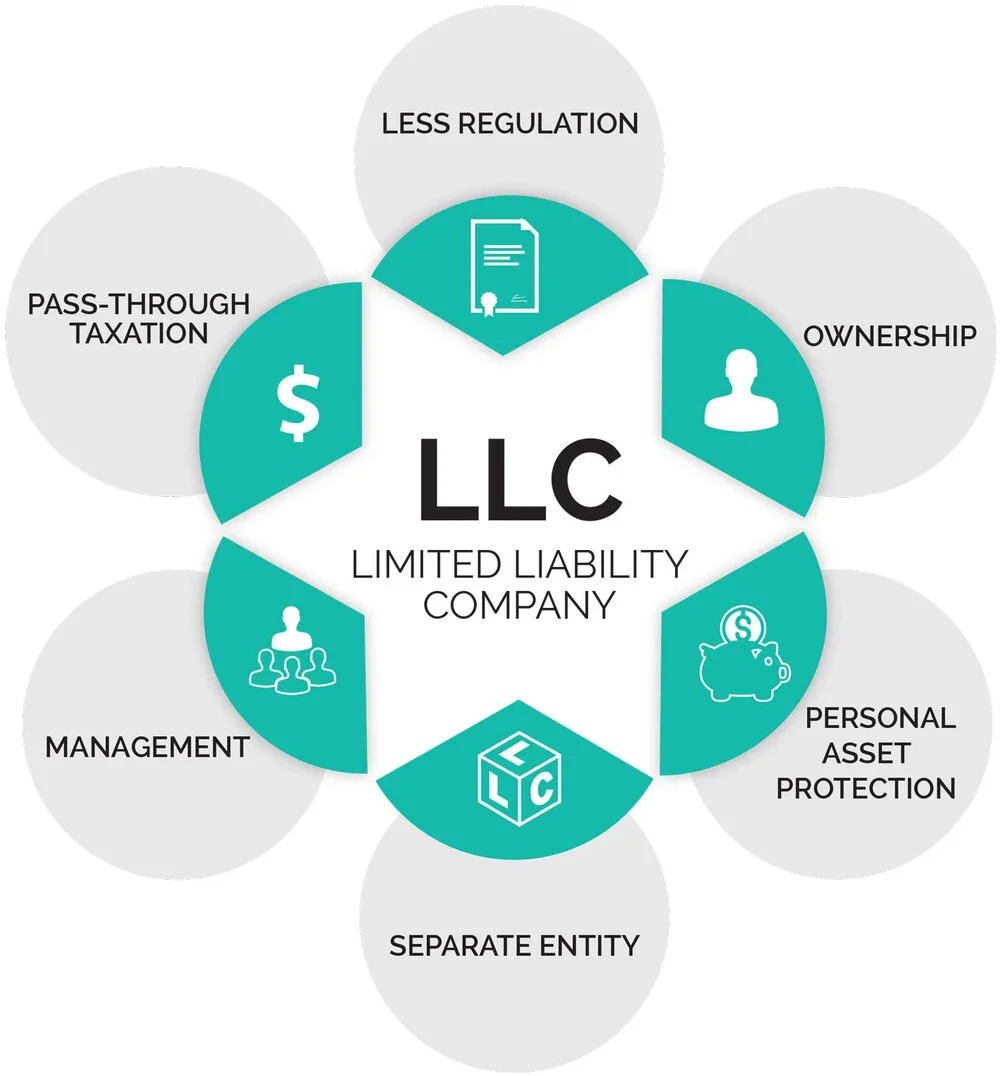

Creating a corporation or specifically an LLC to then purchase an apartment in NYC allows for 3 main benefits.

1) Ownership Structure Makes You Less Liable

One benefit is that the LLC can deflect any risk of liability from being sued personally. The LLC corporate shield protects owners so that if the property in question were owned by an LLC, the owner’s risk exposure would be insulated by the protection of the company, leaving only the assets owned by the LLC (as opposed to all of the owner’s personal assets) exposed to potential lawsuits. In other words, personal finances would not be in jeopardy.

There are legal protections to holding a property as an isolated company rather than in your name or your company’s name, in the event that in the future you opt to rent out the unit. In addition to your homeowners insurance policy, having the property owned in an LLC can protect you as a landlord if your tenant should ever sue you.

2) Transfer of Property

Unlike that of an S Corp, LLCs promote foreign ownership and investment in U.S. real estate. The structure of an LLC makes it easy for anyone to transfer ownership. Real estate holdings can actually be “gifted” to heirs each year, without actually going through the process of signing a deed. In fact, gifting property allows owners to avoid certain taxes. [1]

3) Single Taxation

The LLC can basically become what’s called a “pass-through” entity for profits, avoiding the possibility of proceeds being taxed once as company income and again as individual income of the partners. Speaking with your NY or US Accountant and Financial Advisor is always recommended.

Feel free to email Ross ( contact info below) , and ask about his rates to form a Trust, LLC’s, and close on a property for you.

(Partner)

SCHWARTZ LEVINE PLLC

7 PENN PLAZA, SUITE 210

NEW YORK, NEW YORK 10001

TEL - (646) 518-7273 EXT. 102

FAX - (212) 813-1454

EMAIL- ross@schwartzlevine.com

*Member of NY and NJ Bars

Illustration by: https://howtostartanllc.com/what-is-an-llc

Sources:

[1]:https://www.fortunebuilders.com/beginners-guide-starting-an-llc-part-1/

[2]:https://therealdeal.com/issues_articles/the-rise-of-the-anonymous-llc/

[3]:https://www.brickunderground.com/buy/how-can-I-buy-under-an-LLC